Truecaller Fraud Insurance: Your Defense Against Digital Fraud

Lindsey LaMont

Jun 27, 20242 min read

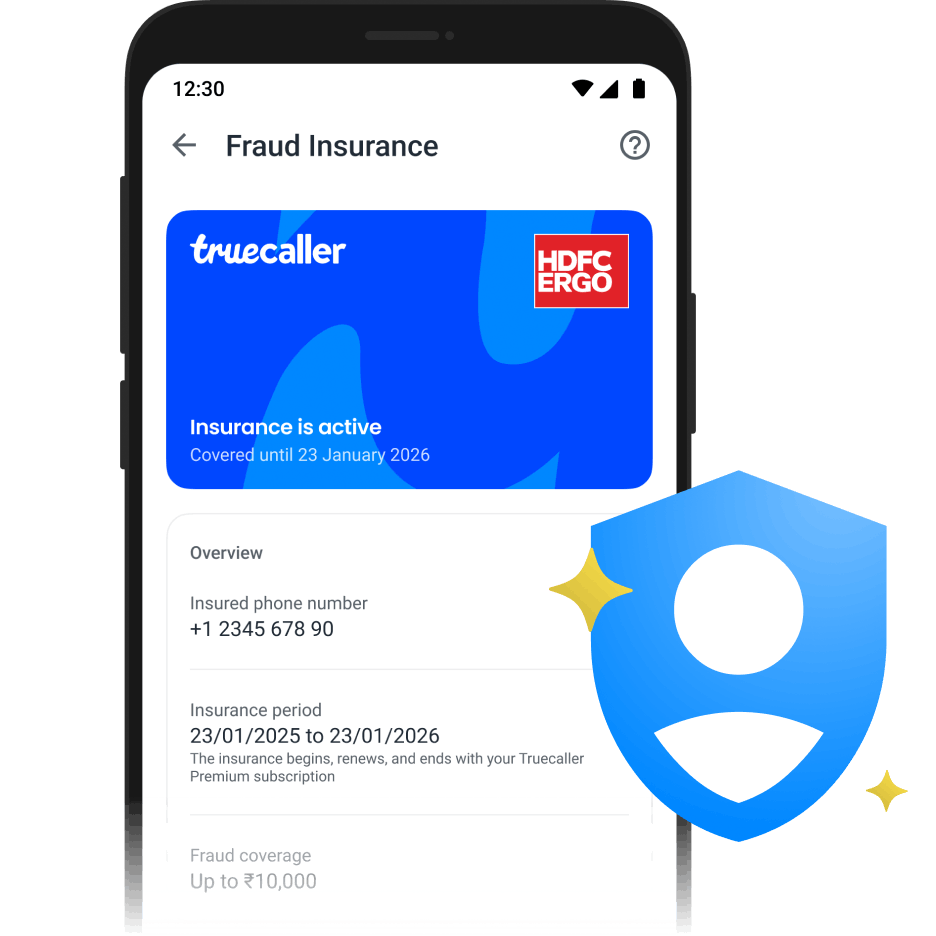

We're excited to share some big news! Truecaller has teamed up with HDFC ERGO, India’s top general insurance company, to launch Fraud Insurance. This new initiative is designed to protect you from digital communication frauds in India.

Rising Digital Fraud Cases

A recent report from the Indian Cyber Crime Coordination Centre shows that digital financial frauds have cost India a whopping INR 1.25 lakh crore over the last three years. As these cases continue to rise, Truecaller remains dedicated to fighting fraud and protecting our users with advanced app features before, during, and after mobile communication.

What is Fraud Insurance?

Fraud Insurance offers coverage up to INR 10,000 for both Android and iOS users across India who have lost money through an SMS/Call scam. If you're a yearly premium subscriber of Truecaller, you can get this coverage at no extra cost. Existing users can also benefit from this protection under their current plan.

- One-tap registration

- If you ever lose money through a SMS/Call scam, you can raise a claim to get your money back.

Seamless and Hassle-Free

No need to worry about additional paperwork. You can enable this insurance instantly through the Truecaller app via your Premium subscription. Our new offering enhances your experience by providing complete protection. From the moment you receive a call to the end of your communication, our AI spam blocking, AI Assistant, call scanner, and Fraud Insurance work together to keep you safe.

How to send a claim through Truecaller

Imagine receiving an SMS with a link to a fake website and unknowingly giving your account information, leading to unauthorised transactions. If a scammer tricks you into sharing your bank details over the phone and makes a purchase, we've got your back!

1. Make sure you are a yearly Truecaller premium user

- Activate your Fraud Insurance through the Premium tab in the app.

- Raise a claim through the premium tab

- You will be redirected to HDFC ERGO to register you claim

Learn more about Fraud Insurance through our FAQ.

Our Commitment to Your Security

Rishit Jhunjhunwala, Chief Product Officer and MD of Truecaller India, says, "We're thrilled to launch this innovative insurance offering as part of our commitment to user security and trust. With Fraud Insurance, we're not just adding a feature; we're reinforcing our dedication to safeguarding our community against digital fraud and giving you the peace of mind you deserve."

Partnering for Your Protection

Vishal Sikand, Joint President of Commercial Lines at HDFC ERGO General Insurance, adds, "The pandemic has increased the use of digital payments, but it has also led to more digital frauds. We're delighted to partner with Truecaller to offer customer-centric innovations and protection from digital frauds."

With the launch of Fraud Insurance, Truecaller is taking another step towards providing comprehensive fraud protection solutions and safeguarding your digital experience.

Stay safe and protected with Truecaller’s Fraud Insurance!

*Disclaimer: Digital theft of funds is covered under HDFC ERGO cyber sachet insurance.

Lindsey LaMont

Jun 27, 20242 min read