419 Scam or Advance Fee Payment Scam

What are Advance Fee (419) Scam in Nigeria

An Advance Fee Scam, commonly referred to as a "419" scam in Nigeria, is a type of fraud where a scammer convinces a victim to pay upfront fees with the promise of a larger sum of money or a lucrative opportunity later. The scam is named after Section 419 of the Nigerian Criminal Code, which addresses fraud and is one of the most prevalent scams in Nigeria. The Advance Fee Scam can take many forms, including inheritance scams, lottery scams, and business opportunity scams.

Examples of Advance Fee Scams in Nigeria are

A scammer might send a letter or email claiming that the victim is the beneficiary of a massive inheritance from a distant relative. To release the funds, the victim is asked to pay legal or processing fees upfront.

For example, Mr. Okeke received an email informing him of a $5 million inheritance from a relative he never knew. To access the funds, he was asked to pay $2,000 in legal fees. After making the payment, the scammer disappeared, leaving Mr. Okeke with nothing.

Victims are informed that they have won a lottery they never entered and are required to pay taxes or fees to claim their winnings.

For example, Mrs. Adebayo received a letter claiming she had won the European Lottery. Excited about the prospect of winning $500,000, she was asked to pay $3,000 for processing fees. After making the payment, she never heard from the so-called lottery officials again.

Scammers offer high-profit investment opportunities requiring initial payments for licenses, fees, or bribes.

For example, Mr. Bello was approached by someone claiming to have insider access to a lucrative government contract. To secure his spot, he was asked to pay a $10,000 bribe. After making the payment, the "business partner" vanished.

In this scenario, scammers claim they need help transferring a large sum of money from a foreign bank account, often telling a story about the rightful owner’s death or political uncertainty.

For example, Dr. Uche received an email from someone claiming to be a lawyer in a West African country, asking for his help in transferring $10 million. In return for his assistance, Dr. Uche was promised a 30% share. He was asked to pay $5,000 in processing fees, after which the lawyer disappeared.

Red flags to look out for in advance fee scam?

Receiving an unsolicited message asking for help transferring funds from another country.

Do not disclose any personal information or trust the phone numbers scammers use. These numbers may appear legitimate, but scammers often spoof numbers.

Offers of a significant financial reward for your assistance in accessing the funds.

Requests for fees to be paid upfront to facilitate the transfer, typically through a money transfer service like Western Union or MoneyGram.

How to protect yourself from 419 advance fee scam?

If something sounds too good to be true, it probably is. Always approach unsolicited offers with skepticism.

Research any company or individual making the offer. Look for reviews or reports of scams online.

Never pay fees upfront for a promise of future financial gain. Legitimate transactions don’t require this.

If in doubt, seek advice from a trusted financial advisor or lawyer before proceeding.

If you suspect you’re being targeted by a 419 scam, report it to local authorities or consumer protection agencies.

The Advance Fee Scam, or 419 scam, remains a prevalent threat in Nigeria, preying on individuals' hopes for financial windfalls. By recognizing the warning signs and taking steps to protect yourself, you can avoid falling victim to these fraudulent schemes. Remember, legitimate opportunities don’t require upfront payments or involve convoluted stories about inherited wealth or secret business deals.

How Scammers Operate 419 Advance Fee Scams in Nigeria

- Communication Channels: Scammers reach out through emails, letters, phone calls, or social media, posing as government officials, businesspeople, or legal representatives.

- Phased Approach: The scam begins with a promise of a lucrative opportunity (e.g., inheritance, lottery win) that requires the victim to pay fees upfront for taxes, legal costs, or bribes.

- Document Forgery: Scammers often provide fake documents, such as letters from banks, government agencies, or law firms, to convince the victim of the scam's legitimacy.

- Multiple Stages: Scammers may ask for additional fees after the initial payment, creating a cycle where the victim continues to pay more money.

Psychological Tactics:

- Promise of Wealth: Scammers lure victims with the promise of receiving a large sum of money in return for small upfront fees.

- Urgency and Secrecy: They pressure victims to act quickly and keep the transaction confidential to avoid jeopardizing the deal.

- Authority Figures: Scammers may impersonate government officials, diplomats, or lawyers to lend credibility to their claims.

Impact on Victims:

- Financial Loss: Victims may lose significant amounts of money through multiple payments to the scammers.

- Emotional Trauma: Realizing they've been scammed can lead to feelings of shame, embarrassment, and distress.

- Legal and Reputational Damage: Victims might face legal consequences if they unknowingly participate in illegal activities.

Where to report 419 scams in Nigeria?

- Police Special Fraud Unit (PSFU)

Email: report@specialfraudunit.org.ng, pro@specialfraudunit.org.ng

Whatsapp: 08127609914

Voice Call/SMS: 07082276895

Social Media: Facebook - Economic and Financial Crimes Commission (EFCC)

Email: info@efcc.gov.ng

Phone number: +234 8093322644, +234 (9) 9044751

Social Media: Facebook, Twitter, Instagram - Independent Corrupt Practices Commission (ICPC)

Email: info@icpc.gov.ng

Phone number: 08076369259, 08076369260

Social Media: Instagram, Twitter, Facebook

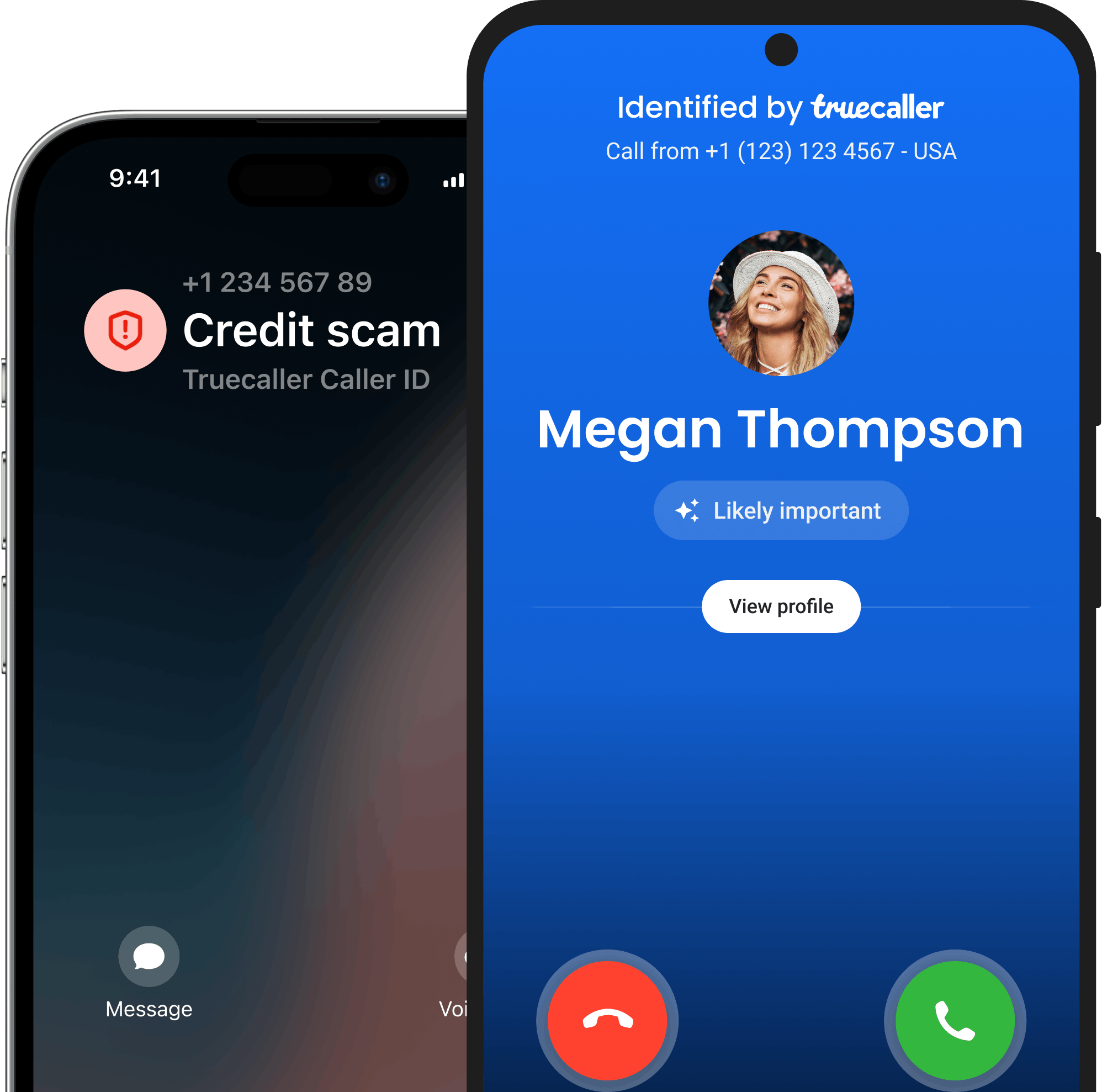

Reporting the scam on Truecaller will help prevent others from becoming victims.

Summary

Advance Fee Scams, or "419" scams in Nigeria, involve fraudsters promising large financial rewards if victims pay upfront fees. Named after Section 419 of the Nigerian Criminal Code, these scams exploit hopes for easy money through methods like inheritance, lottery, or business opportunities. Victims are asked to pay "processing fees" or "taxes," often through untraceable methods, only to lose their money as scammers disappear. Red flags include unsolicited requests, emotional appeals, secrecy, and demands for upfront payments. To protect yourself, avoid paying fees in advance, verify sources, and report scams to authorities such as the EFCC, ICPC, or through Truecaller. Recognizing these tactics helps prevent financial loss and emotional distress.

**The names mentioned in the scams above are fictional, but the scenarios reflect exactly how these scams typically operate.