Investment Scams in Nigeria

Investment Scams in Nigeria

Investment scams are schemes where fraudsters lure people into investing their money in fake or overly risky ventures, promising high returns with little or no risk. These scams often exploit people's desire for quick and easy profits. Scammers use various methods to make their offers seem legitimate and appealing, such as fake websites, glossy brochures, and persuasive sales pitches.

Examples of Investment Scams in Nigeria

These schemes promise high returns to investors from the contributions of new investors rather than from legitimate business activities. The scam collapses when new investments stop, and the earlier investors lose their money.

Similar to Ponzi schemes, pyramid schemes require participants to recruit new members to earn profits. The structure is unsustainable and eventually collapses, leaving most participants with losses. Remember the popular MMM?

Scammers claim to be experts in forex or cryptocurrency trading, promising guaranteed returns. They may use fake trading platforms or manipulate data to show profits, only to disappear with the investors' money.

Scammers offer investment opportunities in non-existent or overvalued properties, promising high returns. Victims may end up with worthless property or lose their entire investment.

You can get a call from someone posing as a portfolio manager or broker. This scammer may get in touch with you over the phone, through email, text message, or even in person, providing information on investments or money matters. They will portray the investment opportunity as low-risk and having the potential to yield significant returns quickly. The fraudster may present the offer as genuine and support their claims with what appear to be reliable sources of information. They are usually persistent and may continue to contact you repeatedly.

In these types of calls, the investments offered often include shares in a company, high-return schemes in real estate or mortgage investments, or foreign currency trading. The scammer might encourage you to buy shares in a company they claim is about to see a significant increase in value. You might receive an email or text message that appears to be an inside tip, stressing the need to act quickly to take advantage of the opportunity.

Red flags to look out for in an investment scam?

Be wary of investments that promise high returns with little or no risk. If it sounds too good to be true, it probably is.

Scammers often create a sense of urgency, pressuring you to invest immediately to secure the "opportunity." Legitimate investments do not require immediate decisions.

Genuine investments are accompanied by clear and thorough documentation. If you are provided with little or no information, it's a red flag.

Verify the legitimacy of the investment firm or individual through regulatory bodies. In Nigeria, the Securities and Exchange Commission (SEC) provides information on registered entities.

Scammers often use complex jargon or claim their methods are too sophisticated to explain. Legitimate investments should be understandable and transparent.

How to protect yourself from an investment scam

Investigate the investment, the company, and the individuals involved. Check with regulatory bodies like the SEC in Nigeria to ensure the investment is legitimate.

Don't be afraid to ask detailed questions about the investment. If the answers are vague or confusing, it's a red flag.

Legitimate investments do not require immediate decisions. Take your time to think and consult with a financial advisor if needed.

Be cautious of unsolicited investment offers, especially if they come from unfamiliar sources.

Avoid putting all your money into one investment. Diversifying reduces the risk of significant losses.

For online investments, use well-known and reputable platforms. Be cautious of new or unknown websites.

Keep up-to-date with common scams and investment risks. Knowledge is a powerful tool for protecting yourself from fraud.

Investment scams are a serious threat, but by being vigilant, doing thorough research, and understanding the common warning signs, you can protect yourself from falling victim to these schemes. Always remember that legitimate investments involve some level of risk, and there are no guaranteed profits.

How Scammers Operate an Investment Scam in Nigeria?

- False Promises: Scammers promise high returns on investments with little to no risk, often using fake or overly optimistic projections.

- Complex Schemes: They may present complex investment opportunities that are difficult for the average person to understand, using jargon to create a facade of legitimacy.

- Ponzi and Pyramid Schemes: These involve paying returns to earlier investors with the funds from newer investors, creating the illusion of a profitable investment.

- Fake Websites and Documents: Scammers often create fake websites, documents, and even fake endorsements to make the investment opportunity seem legitimate.

Psychological Tactics:

- Greed and FOMO (Fear of Missing Out): Scammers exploit the victim’s desire to make quick money or not miss out on a lucrative opportunity.

- Authority and Expertise: They often claim to be financial experts or work for reputable institutions to build trust.

- Pressure Tactics: Victims are often pressured to invest quickly, with claims that the opportunity is limited or will be gone soon.

Impact on Victims:

- Financial Ruin: Victims can lose their life savings or significant amounts of money, which can be devastating.

- Legal Troubles: In some cases, victims may inadvertently become involved in illegal activities if they recruit others into the scam.

- Trust Issues: Victims often develop distrust towards legitimate investment opportunities and financial institutions after being scammed.

Where to report phishing scams in Nigeria?

- Police Special Fraud Unit (PSFU)

Email: report@specialfraudunit.org.ng, pro@specialfraudunit.org.ng

Whatsapp: 08127609914

Voice Call/SMS: 07082276895

Social Media: Facebook - Economic and Financial Crimes Commission (EFCC)

Email: info@efcc.gov.ng

Phone number: +234 8093322644, +234 (9) 9044751

Social Media: Facebook, Twitter, Instagram - Independent Corrupt Practices Commission (ICPC)

Email: info@icpc.gov.ng

Phone number: 08076369259, 08076369260

Social Media: Instagram, Twitter, Facebook - The real organisation needs to be informed of such a scam as well so that if not advertised, they can do so on their official websites and social media accounts that fraudulent job offers are circulating in their name.

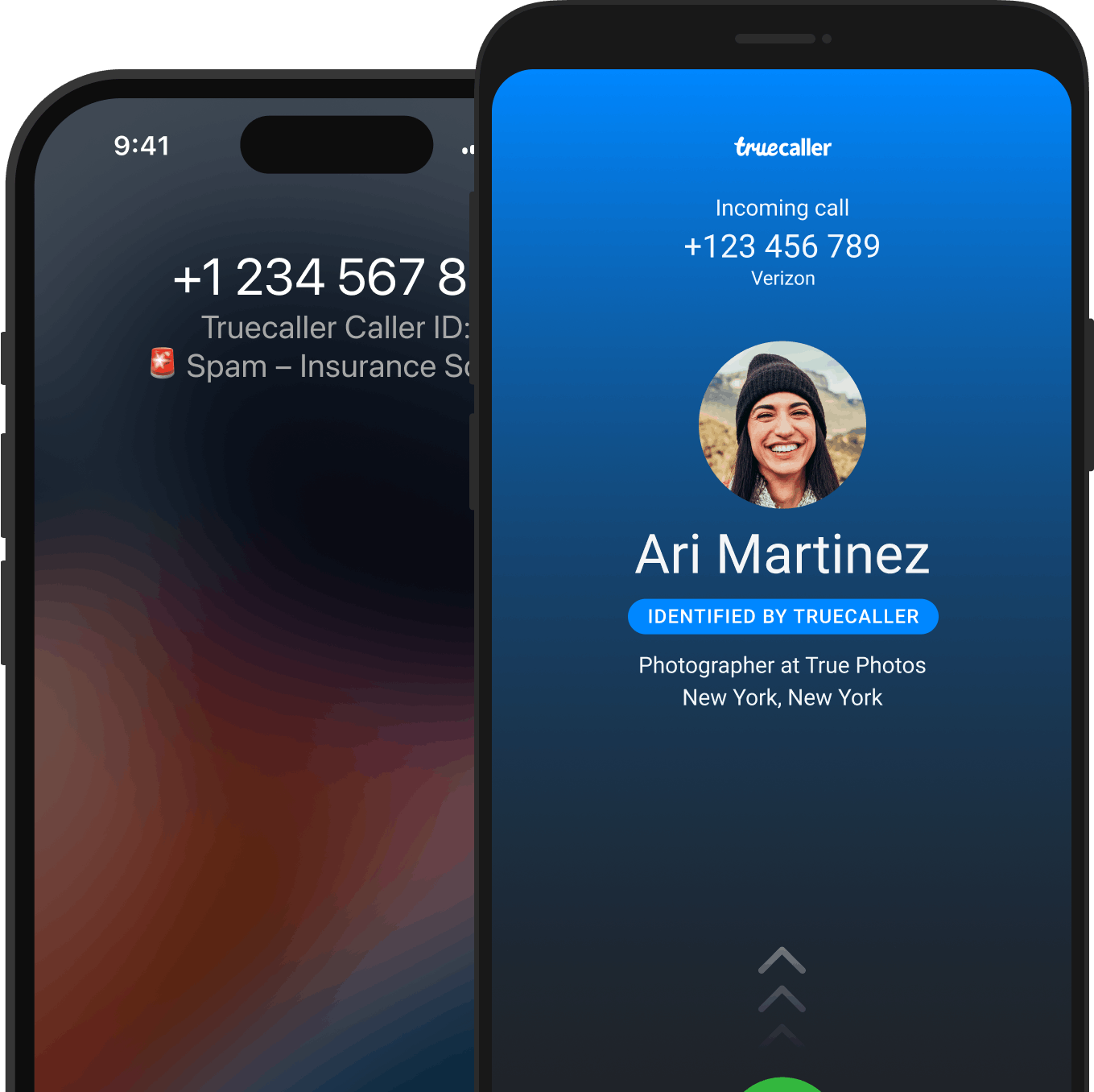

You can also report the phone number of the fraudster on Truecaller. This could protect the whole community from future fraud attempts!

Conclusion

Investment scams in Nigeria, often involving Ponzi schemes, fake forex or crypto trading, and real estate fraud, prey on individuals with promises of high returns and minimal risk. Scammers create urgency and lack transparency, with red flags including unrealistic returns, high-pressure tactics, and unregistered firms. To protect against these scams, individuals should verify with regulatory bodies, avoid unsolicited offers, and use tools like Truecaller to identify and report suspicious numbers. Reporting scams to authorities such as the SEC, EFCC, and local fraud units helps curb these fraudulent activities and safeguards potential victims.