Bank Scams in Nigeria

Bank Scams in Nigeria

A bank scam involves fraudsters impersonating legitimate banks or financial institutions to deceive individuals into disclosing sensitive information or authorizing unauthorized transactions. These scams exploit trust and often create a sense of urgency, convincing victims to act without proper verification. A common bank scam might claim there is an issue with your account, such as suspicious activity or a security breach, to manipulate you into providing confidential details or making financial transfers.

Examples of Bank Scams in Nigeria:

One common form of a bank scam is phishing, where scammers send emails that appear to come from your bank, asking you to click on a link to verify your account details, reset your password, or confirm a transaction. These emails often look very convincing, using the bank's logo and branding to trick you into believing they are legitimate.

For example, you might receive an email that appears to be from your bank, stating that your account has been locked due to suspicious activity. The email urges you to click on a link to "restore access." However, clicking the link directs you to a fake website designed to steal your login credentials.

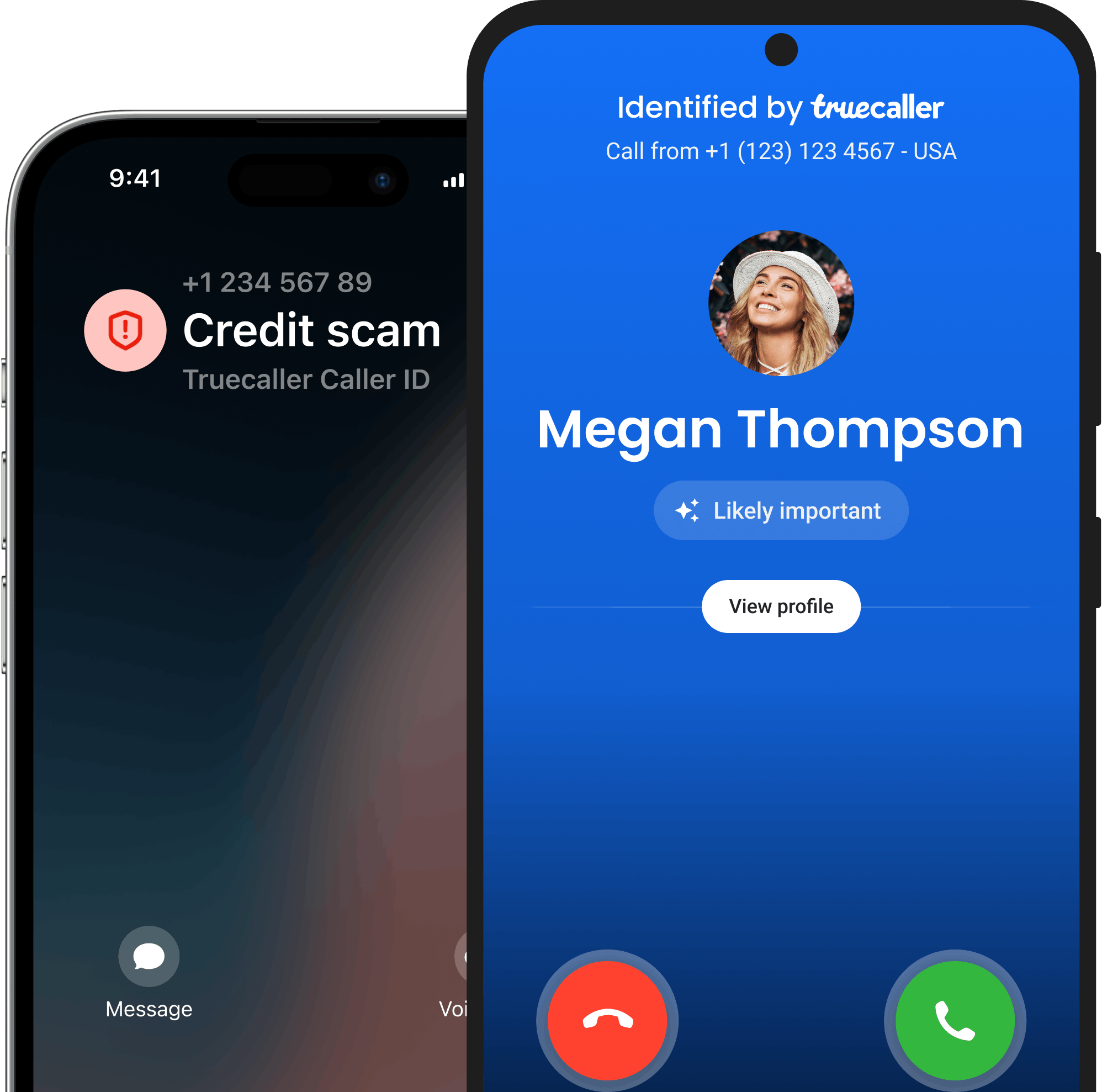

Another prevalent bank scam involves receiving a call from someone claiming to be a bank representative, informing you of a problem with your account. The caller may ask for your account number, PIN, or other personal information to "verify" your identity. These scammers are often highly persuasive and may even imitate the bank's official phone number to make the call appear more authentic.

For example, you might get a call from someone claiming to be from your bank’s fraud department, saying they’ve noticed unusual activity on your account. They ask you to confirm your account number and PIN to secure your funds, but this information is used by the scammer to access your account.

A smishing attack is a type of bank scam where fraudsters send text messages that appear to be from your bank, warning you about suspicious activity on your account. The message urges you to click a link or call a number immediately to resolve the issue. The link typically leads to a phishing site, while the number connects you to a scammer who will ask for your banking details.

For example, you might receive a text message claiming you’ve just won a brand new iPhone 15 Pro Max in this economy! All you need to do is click a link to fill in your delivery details. However, clicking that link could lead to a website designed to steal your personal information.

In a vishing attack, you receive a robocall or a live call from someone claiming to be from your bank's fraud department. This bank scam involves the caller telling you that your account has been compromised and that you need to transfer your money to a "safe" account, which is actually controlled by the scammer. These calls are often very convincing, and the scammers may use technical jargon to sound credible.

For example, you might get a call from someone claiming to be a bank officer, warning that your account has been hacked. They instruct you to transfer your funds to a "secure" account, which is actually a scammer’s account.

This bank scam targets individuals who are selling goods or services online. The scammer "accidentally" overpays you with a check, or transfer, and asks you to refund the difference. The check/ transfer is fake, and by the time the bank discovers this, you’ve already sent the scammer the difference.

For example, you might sell electronics online, and a buyer sends you a check for N250,000 while the agreed amount is N200,000. They then ask you to refund the difference, but by the time your bank realizes the check is fake, or you notice the alert is fake, you’ve already sent them the money.

Fraudsters offer loans at low interest rates but require an upfront fee. Once the fee is paid, the scammer disappears, and the victim is left with no loan, falling victim to yet another bank scam.

For example, you might see an advertisement for a loan with an extremely low interest rate. After applying, the "lender" asks for a processing fee upfront. Once you pay, the lender vanishes, leaving you without a loan and broker than you began.

Red flags to look out for in bank scams:

Receiving unexpected emails, calls, or messages that claim to be from your bank, especially those that request personal information or prompt urgent action, is often a sign of a bank scam.

Messages or calls that create a sense of panic or urgency, insisting that immediate action is required to prevent financial loss or account suspension, are common in bank scams.

Any request for personal information, such as passwords, PINs, or account numbers, especially if the request is made via email, phone, or text, should raise suspicion of a bank scam.

Links that do not match the official website of your bank, or have slight misspellings, and URLs that don’t use secure connections (i.e., lack "https://" and the padlock icon), are typical in bank scams.

Requests for payment via unconventional methods like wire transfers, electronic currency, or money transfers, which are difficult to trace, are strong indicators of a bank scam.

Emails or messages that don’t address you by name but instead use generic terms like "Dear Customer" often signal a bank scam.

How to protect yourself from bank scams in Nigeria

If you receive a call, email, or text claiming to be from your bank, do not respond directly. Instead, contact your bank using the official phone number found on your bank statement, the back of your debit/credit card, or the bank's official website to avoid falling for a bank scam.

Always inspect the website’s URL before entering any personal information. Ensure it’s secure (look for "https://" and a padlock icon) and that there are no spelling errors or unusual domain extensions. Verify the email address as well, ensuring it matches the bank’s official domain to prevent a bank scam.

Be cautious when receiving unsolicited messages, especially those that ask for personal information or prompt you to click on links. Reputable banks will never ask for sensitive information via email, phone, or text as part of a bank scam.

Enable multi-factor authentication (MFA) on your bank accounts for an additional layer of security. This typically involves receiving a one-time code on your phone or email that must be entered along with your password, protecting you from a bank scam.

Keep an eye on your bank statements and account activity. Report any suspicious transactions or unauthorized access to your bank immediately, which can help you avoid or mitigate the effects of a bank scam.

Stay informed about the latest scams, particularly bank scams, and share this knowledge with family and friends. Awareness is one of the best defenses against falling victim to a bank scam.

If you suspect you’ve been targeted by a bank scam, report it to your bank immediately. They can take steps to secure your account and prevent further fraudulent activity. You should also report the scam to the relevant authorities, not forgetting to report the scam number on Truecaller as well.

How scammers operate a bank scam in Nigeria

- Communication Channels: Scammers use phone calls, emails, and SMS to impersonate bank officials, creating a sense of urgency.

- Phased Approach: The scam starts with an urgent message, leading to information gathering and quick execution of unauthorized transactions.

- Collaborative Scams: Involves multiple actors, sometimes with insider assistance, to manipulate the victim.

Psychological Tactics:

- Fear of Loss: Scammers often pressure victims by emphasizing potential financial loss.

- Trust Building: They might build trust by providing partial legitimate information or using formal language.

Impact on Victims:

- Financial Loss: Victims often lose significant amounts of money, either directly from their accounts or through unauthorized purchases.

- Emotional Distress: The realization of being scammed can lead to anxiety, stress, and loss of trust in financial institutions.

- Legal and Reputational Consequences: Victims may face issues with their banks, including frozen accounts or suspicion of complicity in fraudulent activities.

Where to report phishing scams in Nigeria?

- Police Special Fraud Unit (PSFU)

Email: report@specialfraudunit.org.ng, pro@specialfraudunit.org.ng

Whatsapp: 08127609914

Voice Call/SMS: 07082276895

Social Media: Facebook - Economic and Financial Crimes Commission (EFCC)

Email: info@efcc.gov.ng

Phone number: +234 8093322644, +234 (9) 9044751

Social Media: Facebook, Twitter, Instagram - Independent Corrupt Practices Commission (ICPC)

Email: info@icpc.gov.ng

Phone number: 08076369259, 08076369260

Social Media: Instagram, Twitter, Facebook

You can also report the phone number of the fraudster on Truecaller. This could protect the whole community from future fraud attempts!

Conclusion

Bank scams in Nigeria involve fraudsters impersonating bank officials to deceive victims into disclosing sensitive information or authorizing unauthorized transactions. Common tactics include phishing emails, fake phone calls, smishing (SMS phishing), and vishing (voice phishing), all of which create urgency to trick victims into providing account details or transferring funds. Overpayment scams and loan fraud also target unsuspecting individuals. Key red flags include unsolicited communications, urgency, requests for sensitive information, and suspicious payment methods. Protecting oneself involves verifying contacts, checking URLs, enabling multi-factor authentication, and regularly monitoring account activity. Victims should report bank scams to local authorities, the Central Bank of Nigeria, the EFCC, ICPC, and Truecaller to prevent future fraud attempts and help protect the community.

*The people mentioned are fictional but inspired by the true way the scam actually works!