Impersonation Scam in Nigeria

Impersonation Scam in Nigeria

An impersonation scam is a type of fraud where scammers pretend to be legitimate representatives from banks, government agencies, or other well-known companies. Their goal is to trick you into revealing personal information or transferring money. This scam is especially common in our part of the world. Fraudsters may claim to represent entities you trust, like your bank, a family member, a government institution, or a respected company, making their claims seem credible.

Scammers often use sophisticated methods to make their interactions appear legitimate, including using phone numbers that mimic those of genuine organizations.

This tactic is designed to lower your guard and make you more likely to comply with their requests. They might claim that your account has been compromised, that you owe a fine, or that a family member was in a car crash. These scams exploit your trust and fear, pressuring you to act quickly before you have time to think critically.

Examples of Impersonation in Nigeria

Scammers pose as bank representatives, claiming there’s an issue with your account.

For example, Chinwe received a call from someone claiming to be from her bank, informing her that her account was compromised. The caller asked for her ATM PIN and OTP. Shortly after, she discovered that her account had been emptied by the fraudsters. The scammer's use of official-sounding language and urgent tone made the call seem legitimate, leading Chinwe to act without verifying the caller's identity.

Scammers pretend to be recruiters or HR representatives from reputable companies.

For example, Bola received a job offer from a well-known company, requesting a "registration fee" to process her application. She paid the fee, only to find out the job offer was fake. This type of impersonation scam exploits the high demand for jobs, especially in tough economic times, by offering opportunities that seem too good to be true, often through unofficial channels like WhatsApp or personal email addresses.

Scammers might pose as a family member in distress or a concerned individual claiming that a loved one is in trouble.

For example, Chike received a frantic call from someone pretending to be his cousin, saying they were stranded and needed urgent financial help. Another time, someone posed as a hospital official, claiming Chike's sister had been in an accident and needed immediate funds for treatment. In both cases, the scammer's intent was to exploit Chike's emotions and prompt him to send money quickly.

Scammers impersonate officials from agencies like the NIMC or FIRS, demanding payment for fines or services.

For example, Adamu received a call from someone claiming to be from FIRS, threatening legal action unless he paid a fine. The caller was later identified as a scammer. In these scams, the use of legal jargon and threats of severe consequences are common tactics to pressure victims into compliance.

Red flags to look out for in impersonation scams:

Receiving unexpected calls, texts, or emails claiming to be from a trusted organization.

Being asked to provide your bank account details, ATM PINs, OTPs, or personal ID numbers.

Scammers often create a sense of urgency, claiming that immediate action is required to avoid negative consequences.

Requests for payments via bank transfers, cryptocurrencies, or gift cards, which are difficult to trace and recover.

Emails or messages that contain spelling errors, unusual language, or come from non-corporate email addresses.

The caller or sender refuses to provide verifiable contact information or discourages you from verifying their identity through official channels.

How to protect yourself from an impersonation scam?

Always confirm the caller's identity by contacting the organization directly using official contact details. Never rely solely on the information provided during the call. For example, if someone claims to be from your bank, hang up and call the bank directly using the number on the back of your bank card.

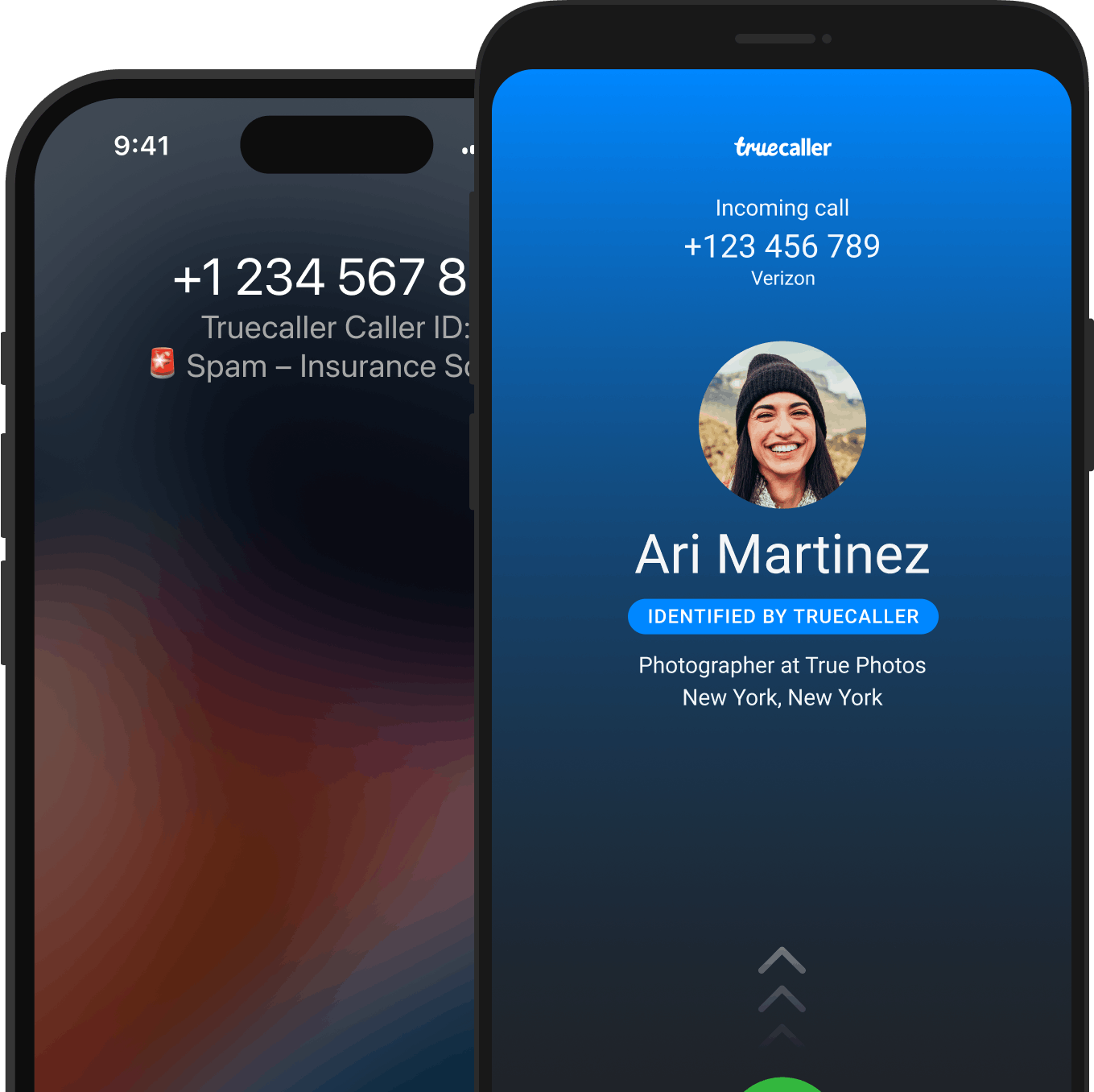

Use the Truecaller app to identify unknown callers and block spam calls. This tool helps you avoid engaging with potential scammers by providing real-time information about the caller, such as their name, location, and whether they have been reported by other users.

Avoid disclosing personal or financial details over the phone, especially if you didn't initiate the contact. Legitimate organizations will never ask for sensitive information like your PIN or password over the phone.

If a call comes out of the blue asking for sensitive information or payment, be skeptical. Reputable organizations do not ask for such details over the phone. If in doubt, take a step back and consult with someone you trust before taking any action.

Protect your accounts by using complex passwords that are difficult to guess. Regularly update them to enhance security. Consider using a password manager to generate and store strong passwords for your various accounts.

Keep up-to-date with common scams and investment risks. Knowledge is a powerful tool for protecting yourself from fraud.

Keep up-to-date on the latest scams and share this knowledge with friends and family. Awareness is a powerful defense against impersonation scams. Regularly read news articles, follow cybersecurity experts on social media, and participate in community awareness programs to stay informed about the latest threats.

Impersonation scams are serious threats, affecting many individuals. By staying vigilant, verifying information, and protecting personal data, you can significantly reduce the risk of falling victim to these scams. Remember, if something sounds too good to be true or if you feel pressured to share information, it's likely a scam.

How scammers operate an impersonation scam in Nigeria

- Identity Theft: Scammers pose as trusted individuals such as family members, friends, or professionals (e.g. doctors, lawyers) to gain the victim's trust.

- Urgent Requests: They create situations that require immediate action, such as claiming to be in an emergency or needing urgent help.

- Mimicked Communication: Scammers may use phone numbers, email addresses, or social media profiles similar to what people are familiar with to appear legitimate.

- Payment Requests: Often, the scam ends with a request for money, either through bank transfers, prepaid gift cards, or cash.

Psychological Tactics

- Emotional Manipulation: Scammers exploit emotions such as fear, sympathy, or love to manipulate victims into acting without thinking.

- Authority Figures: Posing as someone in a position of authority (e.g., a government official) to intimidate victims into compliance.

- Familial Trust: Scammers use the victim's trust in family or close friends to deceive them into providing personal information or money.

Impact on Victims:

- Financial Loss: Victims may lose significant sums of money by sending funds to scammers under pretenses.

- Emotional Distress: Discovering that a loved one was impersonated can lead to feelings of betrayal and emotional trauma.

- Security Risks: Victims may inadvertently reveal sensitive personal information, leading to further scams or identity theft.

Where to report phishing scams in Nigeria?

- Police Special Fraud Unit (PSFU)

Email: report@specialfraudunit.org.ng, pro@specialfraudunit.org.ng

Whatsapp: 08127609914

Voice Call/SMS: 07082276895

Social Media: Facebook - Economic and Financial Crimes Commission (EFCC)

Email: info@efcc.gov.ng

Phone number: +234 8093322644, +234 (9) 9044751

Social Media: Facebook, Twitter, Instagram - Independent Corrupt Practices Commission (ICPC)

Email: info@icpc.gov.ng

Phone number: 08076369259, 08076369260

Social Media: Instagram, Twitter, Facebook

You can also report the phone number of the fraudster on Truecaller. This could protect the whole community from future fraud attempts!

Conclusion

Impersonation scams in Nigeria involve fraudsters posing as trusted representatives from banks, government agencies, or family members to steal information or money. They use tactics like mimicking official phone numbers, creating urgency, and exploiting emotions. Key signs include unsolicited contact, urgent requests, demands for personal information, and untraceable payment methods. To protect yourself, verify contacts independently, avoid sharing sensitive details, use tools like Truecaller to identify unknown callers, and enable two-factor authentication. Report any scams to local authorities, EFCC, ICPC, or Truecaller to help protect others. Staying vigilant and informed is essential to avoid these scams.

*The people mentioned are fictional but inspired by the true way the scam actually works!