Payment App Scams

Payment app scams are on the rise globally. While these apps have greatly simplified sending and receiving money, they have also made it easier for scammers to steal money and sensitive financial information of unsuspecting individuals.

How do payment app scams work?

Payment app scams mostly start with phishing emails or SMS messages. Scammers send harmful links claiming to be from a payment app, which can potentially steal your identity and scam you out of your hard-earned money. Payment fraud is also conducted by sending fake payment screenshots, fooling you into thinking that you have received some money, hacking your payment account, or creating emergency situations to request money under deceptive pretences. Scammers create fake job opportunities or post fraudulent ads for properties and services, asking for payment through apps because of the speed and ease of transactions. And the fact the victim does not get enough time to think through properly.

Common payment app scams

Scammers often impersonate government officials, bank representatives, or payment app customer service, claiming suspicious activity in your account. They instruct you to send money to yourself or the bank to "verify" that your account isn't frozen, but in reality, you're sending it to them. This is a very common scam with apps like Zelle, Venmo and Cashapp in the US.

In India, fraudsters have scammed people by tricking them into approving fraudulent Google Pay requests. In Europe, millions of euros have been lost through Authorised Push Payment (APP) scams, where victims were deceived into transferring money directly to scammers. Similar scams have also been reported in countries like Cambodia, Colombia, and Nigeria, targeting users of payment apps like Mercado Pago, Pi Pay, LOLC Mobile, Flutterwave, OPay, and JumiaPay.

The goal of these scammers is to take over your payment app and carry out unauthorised transactions. They may ask for sensitive information such as your social security number in the USA, Aadhaar card number in India, bank ID and passwords, or debit/credit card information to hack into your accounts and carry out transactions on your behalf. They often impersonate a fake department that wants to verify your personal information.

Fraudsters sometimes pretend to be legitimate businesses and ask for payment through payment apps. If you pay before receiving the product, your money is gone!

Individuals might receive money on their payment apps from a scammer, who will then insist that you send the money back because it was accidentally sent to your account. This money is usually stolen, and the bank or app may eventually discover this. If you send the money back, the amount could be deducted from your account. The scammer might also contact his bank and reverse the transaction, making you lose money twice.

Another form of payment fraud targets business-owners, specifically, where the scammer connects a stolen credit card to a payment app and then purchases products online from their shop. The targeted seller sends the product to the customer only to discover later that it was a fraud pay. Seller loses both his money and the product because money collected in this way is considered a fake bank transaction.

Scammers send spoofed emails to unsuspecting individuals stating that their payment app account is at risk or it will be suspended. They ask for your account details, and if you unknowingly enter them on the fake webpage, those details will later be used to make unauthorised transactions in your name.

Cybercriminals send malware through unsecured websites, fake apps, or email attachments to steal sensitive data, conduct fraud, and commit identity theft. Scammers often send messages that appear to be from payment apps like Venmo, Zelle, or PayPal in the US, aiming to trick victims into sharing personal information. Similar scams have made headlines in other countries, including Colombia, Cambodia, Nigeria, and India, targeting users of apps like Mercado Pago, Pi Pay, LOLC Mobile, Flutterwave, OPay, JumiaPay, and Google Pay.

In this type of payment app scam, scammers target sellers of expensive items who are using P2P (Peer to peer) platforms like Facebook marketplace, Craigslist, OLX or similar websites in other countries. The scammers pose as buyers, claiming to pay via apps like Zelle, PayPal, or Cash App in the US, or Google Pay in India. They claim they've made a payment but ask the seller to upgrade to a business account by adding money to the payment app. The seller, in a rush to make the sale, follows the instructions but the money goes to the scammer’s account instead.

Scammers approach sellers, asking if the item is still available for sale. After the seller replies, the scammer asks for their email address or phone number to send payment through apps like Cash App or Venmo. Soon after, the seller receives a suspicious link via email or text about the order. Clicking on the link could infect the device or allow scammers to hack it.

If you were recently defrauded, scammers might call pretending to be from a payment app's customer care or your bank, offering you a refund. Taking advantage of your eagerness for a refund, the scammers guide you through a confusing process that actually makes you pay them instead of receiving the refund.

If it’s a real lottery or prize, you will never be asked to pay money upfront to access the prize. Emails or texts claiming to be from a payment app often contain harmful links designed to steal your personal information and bank details. To avoid these scams, never click on links unless you know the sender.

Romance scammers play with their victims’ emotions, making them feel as if they are building a relationship with a genuine person. Once the relationship is established, the scammers will create an emergency situation and ask for money. They might also demand gifts or ask you to cover their travel costs. Because payment apps are quick and easy to use, scammers often demand money through those channels.

Pretending to be a family member or friend, scammers often demand money by telling a fake emergency story and asking you to send it via a payment app, as these transactions are quick and often irreversible. They do this by hacking the accounts of people you know or by cloning their accounts.

These scams are common on payment apps. Scammers may pretend to be someone you know or contact you as strangers. Their sole objective is to tell you stories of investment returns that sound too good to be true. Investing through payment apps like PayPal, Venmo, Zelle, or Cash App makes sending money easy, but getting it back is almost impossible.

Another common example of duping people through payment apps is by listing a fake rental property. These rental ads are often priced lower than usual. The scammers pressure victims to act quickly, claiming there is high interest in the property, and urge them to send a deposit or rent immediately through payment apps.

Scammers post appealing job offers on legitimate websites, social media, or send them via email, often promising remote work and high pay. They may conduct fake interviews online, making the process seem professional before offering a bogus job. After that, they ask for payments for training, supplies, or background checks and request that you pay using a payment app.

How to prevent payment app scams?

Ignore unsolicited payment requests or contacts from strangers; they could be bait for a scam.

If possible, use payment apps to transfer money only to people you know.

To pay for goods and services, do not use payment apps—use credit or debit cards instead.

Do not click on random links in emails or SMS messages. They may appear to be from the payment app itself but are most likely phishing links intended to steal your personal data.

Do not give your phone to strangers, as this provides an easy way for a scammer to transfer your money into their accounts.

Ensure your devices are protected by keeping software up to date, using strong passwords, and installing antivirus software to avoid account hacking

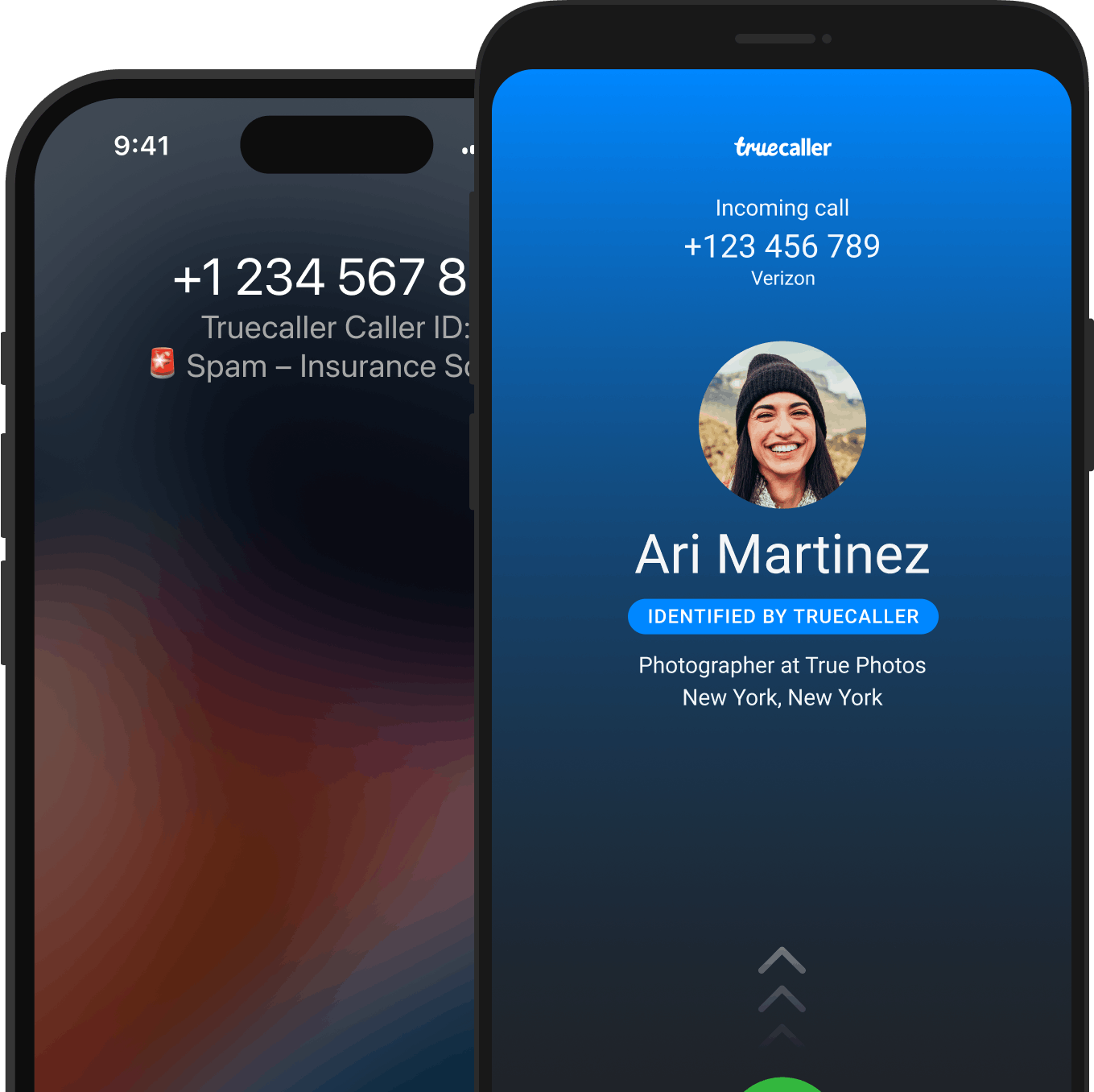

Apps like Truecaller can help in identifying unknown callers or texters, helping with detecting a fraudulent entity early on in a conversation and potentially avoiding the scam.

Victim of a payment app scam? Do this

- Report the scammer in the payment app – As soon as possible report the scammer in the payment app.

- Change your password: It is important that you change your password to a strong one.

- Cut off all contact with the scammer – You may feel angry and desperate after being scammed, but it is very important to block the scammer immediately. Engaging with them in the hope of recovering anything will lead to a dead end. Worse, it could result in being manipulated into paying even more money

- Contact your bank – Inform your bank immediately. Since most payment apps are connected to banks, it is important to notify them right away. If you have disclosed any personal information, such as bank details, IDs, or passwords, this step is essential. The bank will guide you on the necessary course of action and may advise you to temporarily freeze your account until it is secured

- Gather evidence – Cyber cell authorities will need as much evidence as you can provide, such as emails, text messages, chats, payment receipts, etc. All of this information is crucial and could help them track down the scammer and recover your money.

- Monitor your accounts for unusual activity – Regularly review your bank statements and credit reports to ensure no suspicious activity occurs during this period, keeping your accounts safe

Where to report a payment scam

- If you are in the United States, these could be some agencies you could reach out to:

- Federal Trade Commission (FTC): You can file a complaint with the FTC online at https://www.ftccomplaintassistant.gov/

- Internet Crime Complaint Center (IC3): You can file a complaint with the IC3 at https://www.ic3.gov/

Reporting the scam on Truecaller will help prevent others from becoming victims.

- For immediate assistance and guidance on cyber fraud, call 1930 (toll-free)

- File a cyber crime report on

https://cybercrime.gov.in/ or

https://sancharsaathi.gov.in/sfc/Home/sfc-complaint.jsp - Serious Fraud Investigation Office: https://sfio.gov.in/

- Chakshu - Report suspected fraud communication: https://services.india.gov.in/service/detail/chakshu-report-suspected-fraud-communication

- Access the list of state-wise nodal officers and their contact details from

https://cybercrime.gov.in/Webform/Crime_NodalGrivanceList.aspx

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Police Special Fraud Unit (PSFU)

Email: report@specialfraudunit.org.ng, pro@specialfraudunit.org.ng

Whatsapp: 08127609914

Voice Call/SMS: 07082276895

Social Media: Facebook - Economic and Financial Crimes Commission (EFCC)

Email: info@efcc.gov.ng

Phone number: +234 8093322644, +234 (9) 9044751

Social Media: Facebook, Twitter, Instagram - Independent Corrupt Practices Commission (ICPC)

Email: info@icpc.gov.ng

Phone number: 08076369259, 08076369260

Social Media: Instagram, Twitter, Facebook

Reporting the scam on Truecaller will help prevent others from becoming victims.

- CSA Singapore: https://www.csa.gov.sg/cyber-aid

- File a police report at https://eservices1.police.gov.sg

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Action fraud: https://www.actionfraud.police.uk/charities

- Fundraising regulator: https://www.fundraisingregulator.org.uk/complaints

- GOV.UK: https://www.gov.uk/report-suspicious-emails-websites-phishing

- National cyber security centre: https://www.ncsc.gov.uk/

Reporting the scam on Truecaller will help prevent others from becoming victims.

Conclusion

The ease and convenience of payment apps have simplified our lives to a great extent; however, it comes with its own set of problems. They have also become a breeding ground for scammers who use tactics like phishing, impersonation, and fake businesses to steal money and sensitive information. It is important to stay vigilant, never click on suspicious links, and avoid sending money to strangers. If you think you have been scammed, report it immediately to the payment app, your bank, and cyber cell authorities.